Controller and Pricing

Sparring with the goal of higher profitability

An article from Klaus Eiselmayer, member of the board, trainer and consultant of the CA controller akademie

Within the framework of an (existing) business model, pricing is of outstanding importance when it comes to improving the operating result. What a company does not generate in terms of earnings through pricing for a given sales volume can hardly be achieved through cost reductions. As controllers, we are not primarily responsible for pricing. We support the calculation, determine target contribution margins, and calculate the necessary target or minimum sales prices to cover costs and achieve a set profit target.

The sales prices are set in the sales and marketing departments or by the management. As economic advisors and sparring partners, it is the task of controllers to argue for sufficiently high sales prices and, above all, to ensure economic transparency. A salesperson must be aware of the extent to which, for example, a discount impacts the bottom line. This should prevent discounts from being given too lightly. Competence regulations or a contribution margin-oriented remuneration also have an important influence on this.

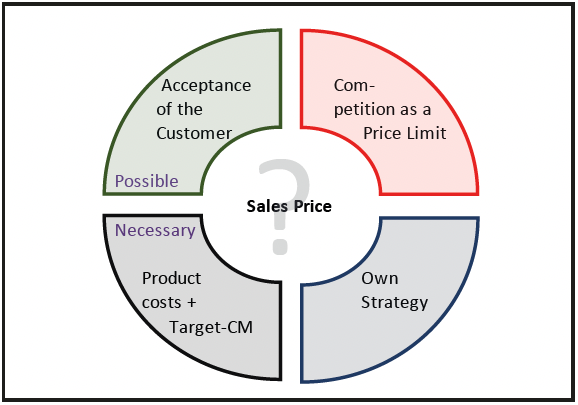

The “price flywheel” (Fig. 1) shows four influencing factors. At the bottom left are the costs that make a certain price necessary. Behind this are capacities, volumes, utilization rates, efficient service provision and lean overhead. Rising commodity prices due to energy and supply chain issues are also visible in this field. One’s own strategy influences this. Do we want to be a low-cost supplier (and can we be that), or do we win customers over with an outstanding performance that others cannot offer in this way. Both will be reflected in corresponding processes and costs. At the top lef t is the question of whether we know our customers and are able to meet their needs, or to put it more clearly: to solve their problems. And do this better and more sustainably than our competitors. If the price gap between us and our competitors becomes too large, this in turn puts pressure on our pricing structure.

Fig. 1: “Price Flywheel” of the CA

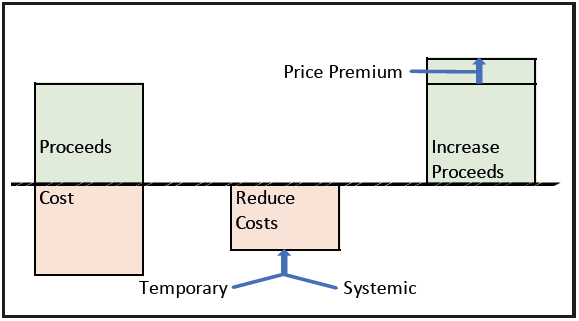

Fig. 2: Options for improving the result

Fig. 2 shows ways of improving results. Costs can be reduced temporarily by relocating to a country with lower costs. “Temporary” because competition will follow. For example, the textile industry has moved production to China, Vietnam, Bangladesh, Myanmar and now Kenya. This sometimes involves buying into additional risks in supply security. “Systemic” means taking advantage of cost degression benefits because you are “the biggest.” Toyota and Volkswagen are in the lead, measured by vehicle sales. If one cannot or does not want to be the cost leader, the option remains to offer the customer a special added value and to take a higher sales price for it (price premium).

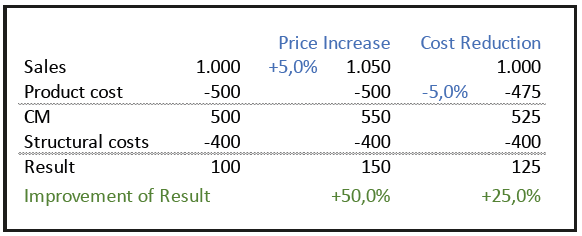

Fig. 3: Price increase vs. cost reduction

The effect of a price increase (for the same sales volume) can be easily illustrated and thus also “sold” within the organization (Fig. 3). For this very reason, it is important that controllers also get involved in the topics of strategy and pricing and not just deal with costs and savings.

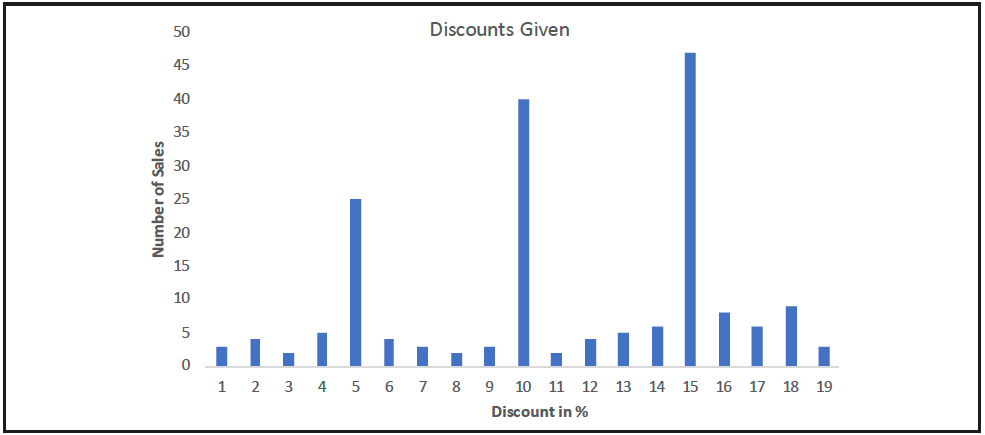

You can get higher net prices by increasing prices or by reducing discounts. In some cases, it is easier to reduce discounts than to increase selling prices. It is important that discounts are not given “lightly” just because the customer asks for them and the salesperson has the authority to do so. Fig. 4 shows an example, in which it can be clearly seen that discounts cluster at the “competence limits” of 5%, 10%, 15% and 20%. One could conclude that responsible staf f obviously exhaust their competence margin on a regular basis. Here it would have to be examined whether we as a company receive a corresponding consideration from the customer, such as larger order volumes, or whether a salesperson just wanted to shorten the discussion. The thresholds presented are also unfavorable because they are easy to see through. The competencies should rather be “odd” values and the jumps should be smaller, so better 4.8%, 9.2%, 13.7% and so on.

Fig. 4: Distribution of discounts

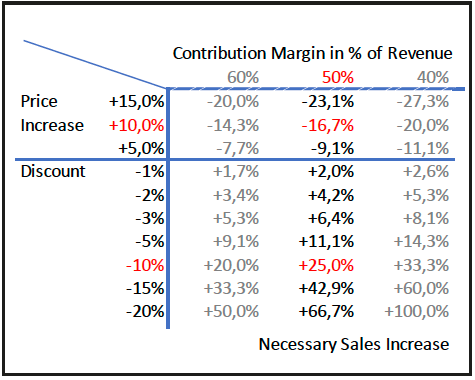

Fig. 5: Price and sales changes

The quid pro quo can be higher sales volumes. Here, I often see that sellers underestimate the effect. In other words, the question of by how many percent sales must be increased to compensate for a certain discount. This ignores other changes such as a possible cost degression with higher volume. Fig. 5 shows that with a 10% price reduction, the quantity would have to be increased by 25%. With a 10% price increase, volume would likely decrease by 16.7% (all this at a 50% margin, i.e., in the middle column).

A next step that is currently on the minds of many companies is the expansion of existing business models. From single sales to subscription models with recurring revenue. From a product to a product with a service component. Customer loyalty can be increased, via rental and leasing models. And here, too, controllers can act as idea generators and get involved as valuable project team members.

Questions for controllers

- Are controllers sufficiently involved in pricing?

- Are individual salespeople aware of the impact of discounts? Are we getting enough in return for giving discounts?

- Are salespeople managed (and bonused) by sales volume and revenue, or also by contribution margins?

- Do we manage to pass on rising raw material prices in full to our customers?

- Does our company offer real added value to the customer, and do we get paid for it by our customers?

- Are the controllers involved in the development of new, promising business models, including the associated pricing?

Some of these questions are talked about in the current issue of the Controller Magazine. Should you want to discuss them with me, you can reach me under k.eiselmayer@ca-akademie.de